Brewery Financial Statements 101:

Brewery accounting, in other words, is not just a general term describing some loosely connected financial activities. As the global beer market continues to grow, breweries that get this step of the process right can gain a crucial advantage. Being able to streamline your accounting and financial reporting means you’re able to focus more specifically on the pieces that make your beer so great. Cash flow management requires that you consistently monitor the amount of money you have on hand, the amount of fixed and variable expenses you’ll face and know how much income you’ll receive and when. Yet, your craft brewery’s demand can be impacted by forces such as weather, local events and even traffic — it’s important to build a safety net (or several) that you can rely on if you do fall short on cash.

Tips For Managing Brewery Financials And Accounting Best Practices

- Using a break even point calculator can help you determine if your sales will be enough to cover your costs and to what degree.

- Depending on where your business is located, you may have extra taxes and regulations to consider.

- A good rule of thumb is to designate an amount equal to 10% of revenues for “other expenses” under uses of cash — so you’ll have some cushion when unforeseen costs arise.

- As far as a timeline goes, your first meeting should be with your leadership team.

- Finally, all entries need double-checked against source documents prior to submitting them into bookkeeping records; this ensures accuracy and reliability going forward.

Yes, Sage is good for accounting if you’re looking for advanced features such as financial analysis and reporting on top of basic accounting functionalities. Sage can also work for startups or mid to large-size companies that are comfortable navigating complex financial accounting and reporting features. When you hire an accounting firm or bookkeeper, you can focus your efforts on other aspects of your business. You can spend time marketing your ecommerce website to draw in new customers and handling other important business decisions while the financial professionals handle these tasks for you.

Diving Into POS Data and Trends With Arryved

Using digital invoices makes this process much easier, as they are less prone to errors than physical invoices because the data is entered and processed electronically. There are a number of other advantages to keeping digital invoices; including efficiency, accessibility, environmental friendliness, and security. Any physical documents (invoices/receipts) should be kept https://www.bookstime.com/articles/full-time-equivalent organized with digital copies stored as backups – this helps maintain compliance with regulations or other guidelines set forth by local governments or organizations. Finally, don’t forget about compliance in your home state (and every other state you do business in). Depending on where your business is located, you may have extra taxes and regulations to consider.

NY Farm Brewery Sales Expansion Advances

Budgets are like weather forecasts, nine times out of ten, they are going to be wrong. That is why what was once considered an annual exercise, should be refreshed more regularly (we recommend monthly) for changing business conditions to ensure company strategies can be pivoted well before it’s too late. However, a brewery cannot succeed on will alone; it needs the numbers to work out, as well.

Advisors and Accounting Solutions

Quotes will include an initial setup fee and an annual license fee, which includes core components, optional modules and users. QuickBooks’ monthly subscription plans start at $30 per month for one-user plans and go up to $200 per month for the Advanced plan. The QuickBooks top-tier plan is more expensive than Sage’s most expensive plan but also includes 25 users versus Sage’s 10 users. The interface is user-friendly, detailed and customizable, making it best for users familiar with accounting practices and financial analysis. However, the advanced features may overwhelm those who aren’t comfortable navigating accounting systems.

Fixed Asset Accounting

This is possible by creating a financial roadmap with a chart of accounts, or general ledger. Anyway, don’t let accounting busy work drag you down — find one of those professional bean counters and let them work their magic. If you do, don’t just hire anyone because there are a lot of firms out there these days that are specifically focusing on craft beer.

Tracking Cash Flow: Purchases And Inventory

As an ecommerce entrepreneur, you’re going to come face-to-face with payroll duties and payroll taxes. With the right platform integrations, you can easily track your sales, returns, and other figures. All your software should integrate so your company operates like a well-oiled brewery accounting machine. Issue invoices at least weekly using accounting software that allows you to track whether an electronic invoice was received and opened via email. Establish notifications to automatically alert the client (and yourself) when an invoice is in danger of being past due.

Brewers Association Enters OSHA Industry Alliance with New York – Brewers Association

Brewers Association Enters OSHA Industry Alliance with New York.

Posted: Mon, 14 Nov 2022 08:00:00 GMT [source]

- Operating a craft brewery may be your dream job, but without a plan to manage your cash flow, the struggle to build a financially stable brewery can feel like a nightmare.

- In this case from a tech + standpoint, secure and cloud-based storage is particularly useful for a smaller business.

- The QuickBooks top-tier plan is more expensive than Sage’s most expensive plan but also includes 25 users versus Sage’s 10 users.

- These requirements consist of three main areas, including generally accepted accounting principles (GAAP)/accounting standards, income statements, and balance sheets.

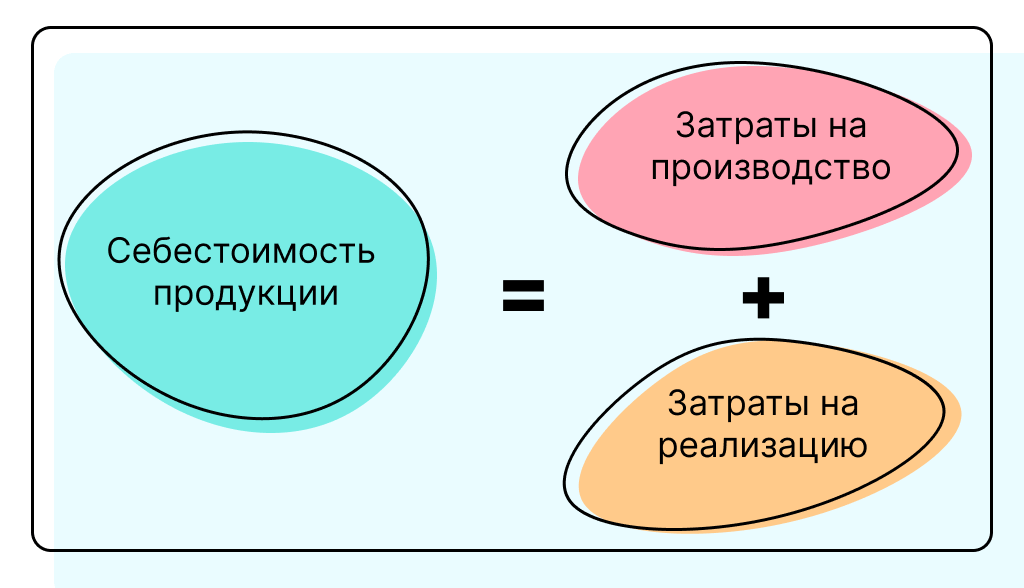

- They will include your cost of goods sold, or the cost of sales, so you can see what income you have due to sales.