Book Value Per Common Share BVPS: Definition and Calculation

Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated. It’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and paid off all of its liabilities. BVPS relies on the historical costs of assets rather than their current market values. This approach can lead to significant discrepancies between the book value and the actual market value of a company’s assets. Over time, the historical cost basis may not reflect the true worth of assets due to inflation, depreciation, and changes in market conditions, leading to potential misvaluation of the company’s stock.

- It’s one metric that an investor may look for if they’re interested in valuating Coca-Cola as a potential investment.

- Value investors prefer using the BVPS as a gauge of a stock’s potential value when future growth and earnings projections are less stable.

- While Book Value Per Share can be a helpful indicator of a company’s tangible net assets, it has several limitations that investors should be aware of.

- BVPS is found by dividing equity available to common shareholders by the number of outstanding shares.

- If XYZ can generate higher profits and use those profits to buy assets or reduce liabilities, the firm’s common equity increases.

- For example, Walmart’s January 31, 2012 balance sheet indicates that shareholders’ equity has a value of $71.3 billion.

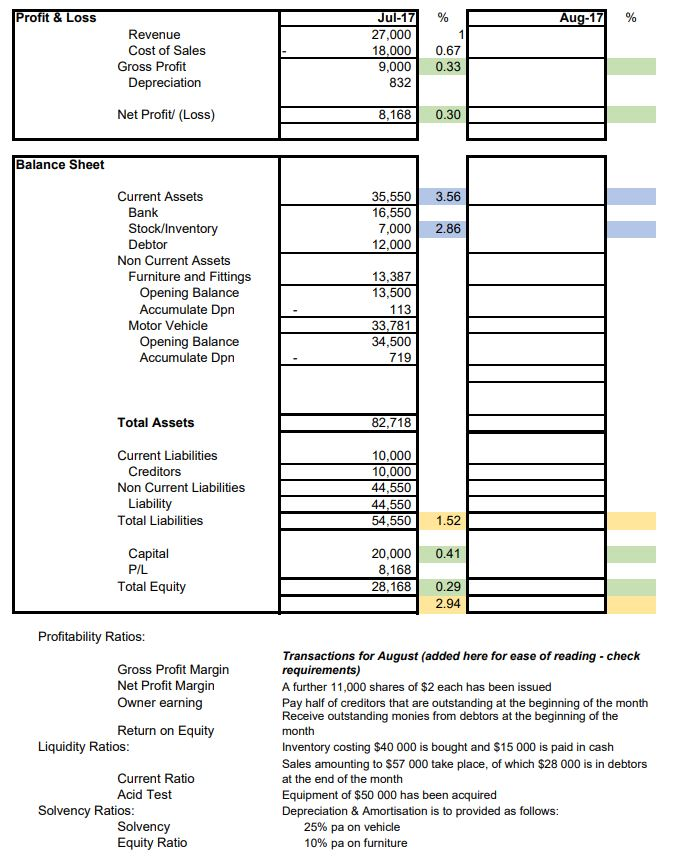

Price-to-Book (P/B) Ratio

On the other hand, if XYZ uses $300,000 of the earnings to reduce liabilities, common equity also increases. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. BVPS is what shareholders receive if the firm is liquidated, all tangible assets are sold, and all liabilities are paid. While corporate debt holders and preferred shareholders are entitled to a fixed series of cash payments, the cash flow in excess of those amounts is essentially the property of the common shareholders.

If there is no preferred stock, then simply use the figure for total shareholder equity. The book value per share and the market value per share are some of the tools used to evaluate the value of a company’s stocks. The market value per share represents the current price of a company’s shares, and it is the price that investors are willing to pay for common stocks. The market value is forward-looking and considers accounts payable and invoice automation best practices a company’s earning ability in future periods.

The Formula for Book Value Per Common Share Is:

The ratio may not serve as a valid valuation basis when comparing companies from different sectors and industries because companies in other industries may record their assets differently. There is also a book value used by accountants to value the assets owned by a company. This differs from the book value for investors because it is only used internally for managerial accounting purposes. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

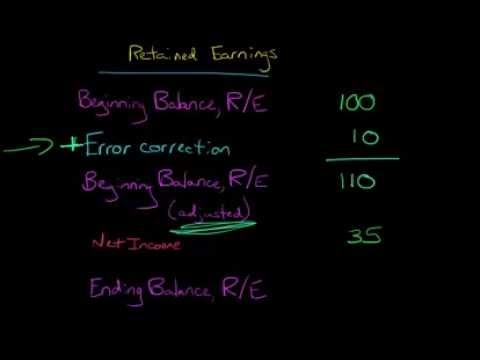

How to Increase the Book Value Per Share

Breaking down the book value on a per-share may help investors decide whether they think the stock’s market value is overpriced or underpriced. In the example from a moment ago, a company has $1,000,000 in equity and 1,000,000 shares outstanding. Now, let’s say that the company invests in a new piece of equipment that costs $500,000.

If XYZ can generate higher profits and use those profits to buy assets or reduce liabilities, the firm’s common equity increases. For example, Walmart’s January 31, 2012 balance sheet indicates that shareholders’ equity has a value of $71.3 billion. The number is clearly stated as a subtotal in the equity section of the balance sheet.

Investors can compare BVPS to a stock’s market price to get an idea of whether that stock is overvalued or undervalued. On the other hand, book value per share is an accounting-based tool that is calculated using historical costs. Unlike the market value per share, the metric is not forward-looking, and it does not reflect the actual market value of a company’s shares.

Book value is the accounting value of the company’s assets less all claims senior to common equity (such as the company’s liabilities). For example, let’s say that ABC Corporation has total equity of $1,000,000 and 1,000,000 shares outstanding. This means that each share of stock would be worth $1 if the company got liquidated. To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding.

Value investors use BVPS to identify stocks that are trading below their intrinsic value, indicating potential undervaluation. While Book Value Per Share can be a helpful indicator of a company’s tangible net assets, it has several limitations that investors should be aware of. If a company’s share price falls below its BVPS, a corporate raider could make a risk-free profit by buying the company and liquidating it. If book value is negative, where a company’s liabilities exceed its assets, this is known as a balance sheet insolvency. Comparing BVPS to the market price of a stock is known as the market-to-book ratio, contact inland northwest bookkeeping or the price-to-book ratio.