Dollar-value LIFO places all goods into pools, measured in terms of total dollar value, and all decreases or increases to those pools are measured in terms of the total dollar value of the pool. In the event that inflation and other economic factors (like supply and demand) were not an issue, dollar-value and non-dollar-value accounting methods would have similar outcomes. At the point when prices are decreasing, dollar-value LIFO will show a diminished COGS and a higher net income. Dollar value LIFO can assist with lessening a company’s taxes (expecting prices are rising), however can likewise show a lower net income on shareholder reports. Recent changes in accounting standards have introduced new complexities and considerations for businesses employing Dollar-Value LIFO.

Dollar Value LIFO Definition Becker

It also helps in deferring tax liabilities, as the higher costs reduce taxable income. The dollar-value LIFO method allows companies to avoid calculating individual price layers for each item of inventory. However, at a certain point, this is no longer cost-effective, so it’s vital to ensure that pools are not being created unnecessarily. Dollar value LIFO can help reduce a company’s taxes (assuming prices are rising), but can also show a lower net income on shareholder reports.

Effective Cash Book Management for Modern Finance

- The price index is a crucial part of the Dollar Value LIFO method that helps account for inflation when calculating the worth of inventory.

- First, a large number of calculations are required to determine the differences in pricing through the indicated periods.

- Under this method, goods are combined into pools and all increases and decreases in a pool are measured in terms of total dollar value.

- However, this also means higher tax liabilities, as the lower COGS increases taxable income.

In an inflationary environment, it can more closely track the dollar value effect of cost of goods sold (COGS) and the resulting effect on net income than counting the inventory items in terms of units. Like specific goods pooled LIFO approach, Dollar-value LIFO method is also used to alleviate the problems of LIFO liquidation. Under this method, goods are combined into pools and all increases and decreases in a pool are measured in terms of total dollar value. This method requires extensive record-keeping and complex calculations due to fluctuating inventory values. It can lead to significant variances in financial statements, especially in volatile pricing periods, potentially complicating performance assessments for investors.

Practical Applications of Dollar Value LIFO Formula

When the adjusted ending inventory exceeds the beginning inventory, it indicates additional purchases, and a new layer is created for the amount of the increase. Choose a base year for the Dollar Value LIFO method, as it’s the year to which you will compare all subsequent years. You will use the prices in this year as a base to interpret changes in the value of the inventory. However, remember, the chosen base year doesn’t influence the dollar value of the inventory; it’s only a point of reference.

Interpretation of Dollar Value LIFO Formula

Once the actual increase is computed, it is then adjusted for current year prices and then we can know the total value of ending inventory under dollar-value LIFO. Under Dollar-Value LIFO, COGS tends to be higher because it reflects the most recent, and typically higher, costs of inventory. This increase in COGS reduces the gross profit margin, which in turn affects the net income. While this might seem disadvantageous at first glance, it can be beneficial from a tax perspective. Higher COGS leads to lower taxable income, thereby reducing the company’s tax liability.

Advantages and Disadvantages of Dollar Value LIFO Inventory

The rationale behind Dollar Value LIFO isn’t merely theoretical; it’s an approach you’ll encounter regularly in inventory management within diverse industries and businesses. The capability of this formula to account for fluctuations in prices and inventory quantities efficiently makes it quite practical in real-world scenarios. A more detailed the difference between gross and net lease review of the Dollar Value LIFO inventory method provides a broader understanding of its applications in business and accounting. This depth of knowledge is not just beneficial for academic purposes, but also proves advantageous in real-world business scenarios, aiding better decisions regarding inventory control and financial accounting.

This example also makes it explicit that the Dollar Value LIFO method isn’t just about the physical quantity of the inventory. While implementing this method, the focus should be on the fluctuations in price levels and their impact on the inventory’s dollar value. A practical example can serve as a highly effective approach to ensure a solid comprehension of the Dollar Value LIFO method.

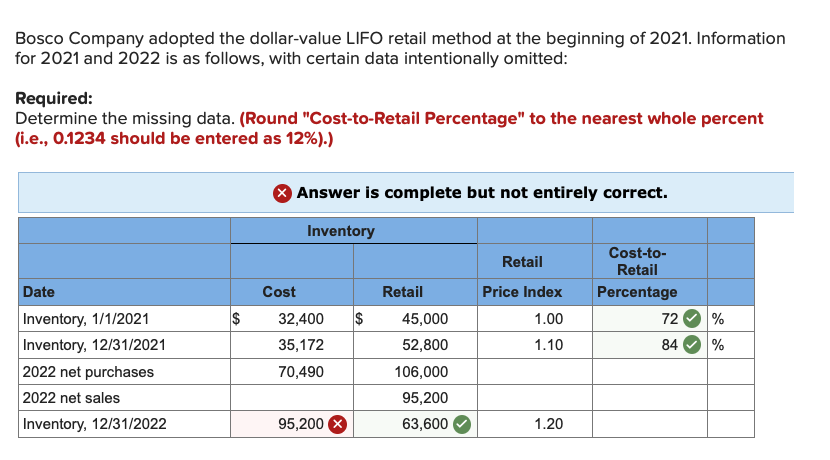

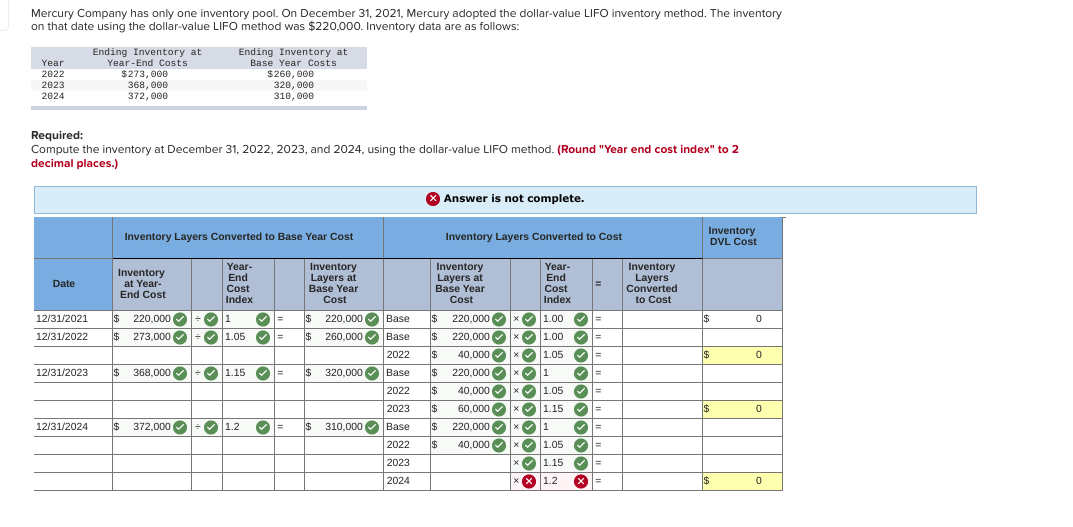

Always consult with an accounting professional or financial advisor when dealing with inventory valuation. The LIFO retail inventory method employs the Last-in, First-out costing method to estimate ending inventory costs. It involves allocating the cost-to-retail ratio to both the beginning inventory and the current period’s layer. In contrast, the dollar-value LIFO retail method considers LIFO principles and adjusts for changes in inventory prices by incorporating fluctuations through the price index. Unlike the prior approach, this process explicitly incorporates variations in inventory prices to determine the estimated cost of ending inventory at annual closing.