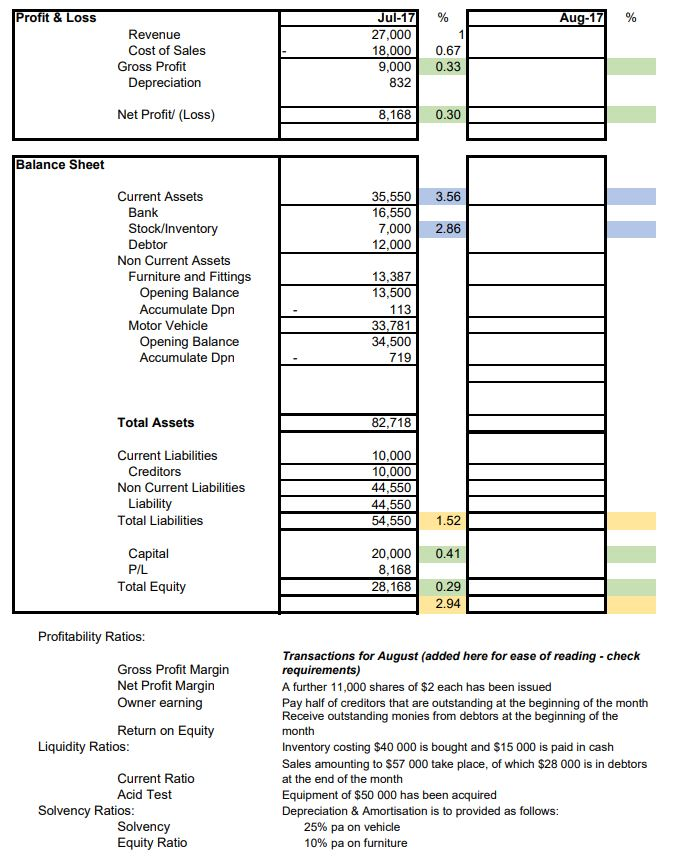

Doctors should consistently review the income statement, balance sheet, and cash flow statement. It is one of the important accounting and bookkeeping requirements for healthcare professionals. Regular analysis of these statements ensures sound financial health and informed decision-making. By banking on doctor bookkeeping services, healthcare practices can generate accurate financial statements for practices. To optimize accounts receivable, healthcare practices should enforce timely invoicing, efficient medical coding, and diligent follow-up on unpaid claims. Monitoring Medicare/Medicaid billing processes and automating reminders also enhance cash flow management and effective healthcare revenue cycle management.

We understand the healthcare industry and know how to profitably manage the financial side of your practice with a wide range of medical accounting services. With our accounting for doctors services, your practice will streamline accounting processes and meet or exceed industry benchmarks. Protecting financial data in outsourced accounting and bookkeeping for physicians involves using advanced encryption, secure access protocols, and conducting regular security audits. To maintain compliance with healthcare regulations, it’s essential to accurately manage Medicare/Medicaid billing, medical coding, and financial reporting. At Invensis, we have more than 24 years of experience streamlining financial management for medical practitioners. We handle all aspects of your financial needs, from tracking and monitoring day-to-day expenses to managing payroll and financial reporting.

Pay your team

In addition to working with a acquisitions and payments cycle skilled medical billing team to speed up collections, work with your accountant or bookkeeper to prepare cash flow forecasts. This will help you spot potential cash shortages before they happen so you can make a plan to trim expenses, ramp up collections, or tap a business line of credit. When you started your medical practice, you likely took on far more responsibility than you imagined. Not only are you responsible for providing patient care, but you’re also the accountant, marketing manager, human resources manager, and more.

As a result, medical practices must establish even more efficient systems for tracking and organizing data. Healthcare accounting must adhere to various laws and regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA). This requires accurate and compliant financial reporting, maintaining patient privacy in billing processes, and understanding the financial implications of healthcare regulations. Our bookkeeping services include maintaining detailed ledgers, preparing monthly financial statements, reconciling accounts, and providing insightful financial analysis.

One of the reasons healthcare providers often struggle to run their practices’ accounting effectively is that business management is well outside their expertise. As a result, the accrual basis is much better at matching revenues with expenses and accurately representing your business’s financial situation. Owning your own medical practice is an exciting prospect, but it comes with additional accounting responsibilities. While you’d probably prefer to focus on providing healthcare services to your patients, you can’t afford to ignore the business side of your operation. Medical practice accounting is different from accounting for other types of businesses.

Medical Practice Accounting 101: Understanding Your Financial Statements

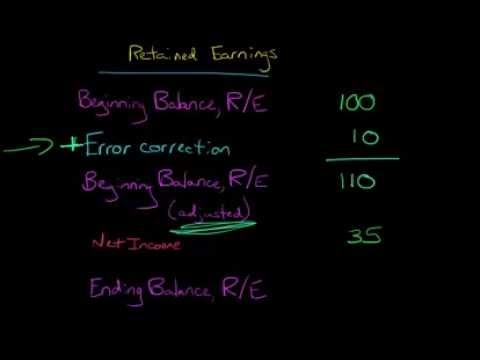

As a result, you need to take the time to review your financial statements and reports to draw conclusions that can inform your business decisions. Neither is inherently superior, but the accrual basis is generally better suited to medical practices. As the healthcare landscape continues to change, so too must the strategies and methodologies in medical accounting, necessitating a proactive and informed approach to financial management. Consult with a healthcare financial advisor or accountant who understands the specific nuances of medical practice accounting. Professional advice is crucial, especially when deciding on an accounting method that will align with how do i calculate depreciation using the sum of the years’ digits both current needs and future goals.

- An ancillary effect is that patients and the public often don’t know what to expect in terms of care costs and may be surprised by practices such as balance billing.

- Know how Invensis provides accurate accounting & bookkeeping services for a restaurant which helps effective cost monitoring and growth.

- Here are some best practices you can implement to optimize your accounting function and minimize the time you have to spend managing it.

Related Services

As you are extremely busy taking care of your patients, you don’t have enough time to navigate all the changes in your industry’s financial and taxation landscape. Advanced Professional Accounting Services partner with you and makes a visible real-time difference in your practice’s financial side. By using industry-specific techniques, innovative tools, our knowledge about the latest regulations and experience, we limit your tax exposure depreciation definition and boost profitability. Every decision made in health care can, and usually does, have an impact on patient health. The work can often involve finding ways to make a facility’s patient care strategies more financially efficient without sacrificing overall care quality.

Reporting

We offer nationwide online CPA services to physicians, so please reach out to learn more. When you’re looking through accountant websites, make sure you select providers who demonstrate a clear understanding of healthcare accounting challenges. Use the free consultation and ask each one how they deal with insurance and medical billing issues. Unfortunately, medical practices provide services to their patients but have to coordinate payment between them and their insurance companies. There are many more moving parts than usual, and it’s much easier for things to go wrong.