Now, we got a concrete understanding of the nature of this account balance. So, we can try to resolve all the basic questions like the type of Account, applicable accounting rules, and different considerations before recording the journal entry. A company records an increase in this liability paid telephone bill journal entry each period as the amount of accrued interest increases. Even though the December bill has not been recorded in the books, the fact is that the service has been received, and hence expenses incurred. The phone service charge will be recorded as the expense in the customer income statement.

Why are accrued interest and salary expenses often not recorded until after the end of the accounting period?

Let’s say that you paid for six months of office rent upfront in January. The amount that was prepaid (rent for February through June) gets recorded as an asset in a prepaid rent account. The timeline below shows the total amount of salaries expense for the week ended Friday, 4 January 2018. It also indicates how much expense should be allocated between the two years.

Kalp Accounting Learning Articles

It means that the customer will use the service and pay in the following month. It is opposite from the prepaid phone that customers top up the phone and use later. Therefore, the net Entry will knock off the Liability account, telephone expenses will be on the debit side, and Bank Accounts will be on the credit side. This is because 1) more expenses mean 2) less profit and 3) less for the owner. The external parties’ stake in the assets of the business (i.e. liabilities) has increased by $200 to $5,200 as a result of this telephone bill that is owing. Adjusting entries must be made for these items in order to recognize the expense in the period in which it is incurred, even though the cash will not be paid until the following period.

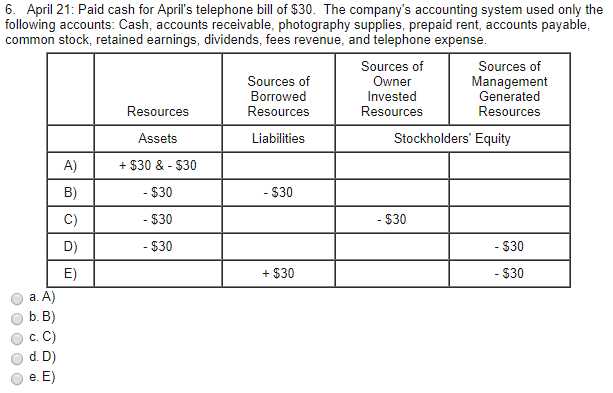

How do you record the “Paid Cash for telephone bill” transaction?

This GL is a Liability account, and it’s part of a Personal Account. Finally, the adjusting journal entry on 31 December 2017, along with the entry to record the payment of salaries on 4 January 2018, is given below with T accounts. Therefore, accrued salaries payable must be recorded for salaries earned by employees but that are unpaid through the end of the accounting period. When ABC receives telephone invoices, they have to record telephone expenses and accounts payable. The journal entry is debiting telephone expense $ 500 and credit accounts payable $ 500.

A note payable is a promise in writing to pay a specific amount of money by a specific future date. Like accounts payable, notes payable are recorded as liabilities. Our creditor (liability) exists currently in our records at $200 on the credit side (right).

- So, the telephone bill is debited, and the bank account will be credited.

- The telephone charges a/c is debited and the respective cash or bank a/c is credited.

- The interest is based on the previous outstanding principal balance of the note.

- It is common for bills to be received after the end of the year, which actually relate to a service received before the year-end.

Accrued Expenses: Explanation

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. After the trial balance had been drawn up, the December bill arrived, which was for $870. Petty cash is an account of cash that’s usually kept on hand and used for small purchases, like office supplies. In business, doubtful accounts refer to any amount that you don’t expect to collect. Typically, you record depreciation at the end of the year to show how much value the long-term assets have lost during the year.

You will also credit Telephone Expense for $20 when you record the $20 receipt from the employee. While you don’t need to make an accounting entry when you spend petty cash, you do need to record an entry when you move money from your cash account to the petty cash account. In that case, you can use accrued expenses (also known as accrued liabilities) to record unpaid expenditures that you have to estimate, such as your utilities or income taxes. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The salaries for the next 4 days of the week, or $1,200, are the expense of the next year, 2018. An adjustment must be made on 31 December 2019 to record the interest expense that was incurred between 1 October 2019 and 31 December 2019.

There are several types of expenses you can incur as a result of owning and operating a business. Keeping track of the money that leaves your business may not be as fun as counting the revenue you bring in through sales. But understanding how much you spend is just as important as knowing how much money you make. Let’s discuss how to pass Journal Entry and post them into their respective Ledger Account, when Telephone Expenses are paid through Bank Account. Let’s discuss how to pass Journal Entry and post them into their respective Ledger Account, when Telephone Expenses are paid by Cash. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Interest and salary expenses are accrued because the date that these items are paid does not necessarily correspond to the last day of the accounting period. For example, interest is often paid on a monthly or quarterly basis, while salaries are normally paid at regular intervals for work completed within the given period. The primary step in recording transactions is to familiarize yourself with the business and the nature of the trade and learn the accounting rules to apply for a specific transaction. Depreciation is an accounting tool businesses use to record the loss in value of physical assets (like vehicles or machinery) over time. It’s recorded on financial reporting documents, like balance sheets and income statements.