Accounting Equation Assets = Liabilities + Equity

When the total assets of a business increase, then its total liabilities or owner’s equity also increase. The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity). While assets equal the sum of liabilities and equity, they do not equal liabilities alone. Here we see that the sum of liabilities and equity equals the total assets and the equation balances.

- Embark on an insightful journey to decode the accounting equation, a fundamental concept in finance.

- The accounting equation is ingeniously designed to always remain balanced, meaning the total amount of assets will always equal the sum of liabilities and equity.

- Bankrate.com is an independent, advertising-supported publisher and comparison service.

- Additionally, financing strategies should be assessed as they can determine the overall fiscal health.

- It represents the total profits that have been saved and put aside or “retained” for future use.

How is the balance sheet equation used in financial analysis?

Our popular accounting course is designed for those with no accounting background or those seeking a refresher. Thomas Richard Suozzi (born August 31, 1962) is an how to get around turbotax says “medical expenses .. accomplished U.S. politician and certified public accountant with extensive experience in public service and financial management. He is known for his pragmatic approach to fiscal policy and governance.

Omissions only cause accounting equation to unbalance if only one side of an accounting entry is excluded from the record. Transactions that increase the resources of a business are added to both buckets, while transactions that decrease resources are subtracted similarly. Assets, liabilities, and equity are the three pillars of the accounting equation, each serving a distinct role. The U.S. Treasury Department and the Federal Reserve keep an eye on companies’ debts. They look at this info to check how well a company is doing financially and how it handles its debts. For example, the debt-to-equity ratio shows how much debt a company has compared to its value.

It allows stakeholders to analyze how their investment, sales, or other inputs affect the company’s financial health and dollar value. Understanding how revenue transactions and expense transactions impact these accounts further aids in maintaining a balanced equation. Equity represents the owner’s claim on the company’s assets after all liabilities have been paid off. Shareholder equity can be broken down into paid-in capital—contributed by original stockholders—and retained earnings. The shareholders’ equity number is derived by subtracting total liabilities from total assets, ensuring the balance sheet accurately reflects the company’s financial state. By balancing these components, the equation ensures that for every dollar invested in assets, there is a claim by creditors and owners, promoting transparency and accountability in financial statements.

To see a live example of how the accounting equation works let us utilize the 3M 2023 Annual Report. Owner contributions and income result in an increase in capital, whereas withdrawals and expenses cause capital to decrease. Being an inherently negative term, Michael is not thrilled with this description.

- These limitations highlight the necessity of using the accounting equation in conjunction with other financial analyses to paint a fuller picture of a company’s economic landscape.

- Long-term liabilities, on the other hand, include debt such as mortgages or loans used to purchase fixed assets.

- The balance sheet equation lets businesses calculate important financial ratios.

- They help analysts dissect the economic effects of transactions, offering insights into liquidity, solvency, and profitability.

- Common examples of assets found on a balance sheet include accounts receivable, cash, buildings, and inventory.

Assets = Liabilities + Equity

Let’s consider a company whose total assets are valued at $1,000. In this example, the owner’s value in the assets is $100, representing the company’s equity. In accounting, the company’s total equity value is the sum of owners equity—the value of the assets contributed by the owner(s)—and the total income that the company earns and retains.

What Is a Liability in the Accounting Equation?

By using the above calculation, one can calculate the total asset of a company at any point in time. Ltd has below balance sheet for 5 years, i.e., from the year 2014 to 2018. Suppose a proprietor company has a liability of $1500, and owner equity is $2000. Calculation of Balance sheet, i.e., Total asset of a company will sum of liability and equity. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined.

For Businesses

Understanding the net income equation is vital as it relates to the equity account balances, reflecting on a firm’s profitability since its inception. Overall, the accounting equation serves as a financial barometer, guiding businesses toward sustainable fiscal practices. It makes sure the balance sheet is always right, with assets matching liabilities and equity. Assets are split into current assets (like cash and inventory) and non-current assets (long-term investments and equipment). This helps understand a company’s quick cash and financial strength. Investors use the balance sheet equation to check a company’s financial setup and value.

What is the relationship between assets liabilities owner’s equity in the accounting equation?

Equity and liability collectively represent the total funds that a business has obtained from and owes to its providers of finance. In financial analysis, accounting equations serve as powerful tools to interpret a company’s financial health and decision-making pathways. They help analysts dissect the economic effects of transactions, offering insights into liquidity, solvency, and profitability.

Understanding Balance Sheet Equation

These are listed at the bottom of the balance sheet because the owners are paid back after all liabilities have been paid. With liabilities, this is obvious—you owe loans to a bank, or repayment of bonds to holders of debt. Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds are given out. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. This financial statement is used both internally and externally to determine the so-called “book value” of the company, or its overall worth.

If you want to calculate the change in the value of anything from its previous values—such as equity, revenue, or even a stock price over a given period of time—the Net Change Formula makes it simple. The accounting equation should balance if the accounting entries are correctly recorded. Because the same amount is added and subtracted from both buckets, the accounting equation always remains in balance. You should also include contingent liabilities or liabilities that might land in your company’s lap. This could include the cost of honoring product warranties or potential lawsuits.

A company’s financial risk increases when liabilities fund assets. The accounting equation is essential for producing precise financial reports. Every transaction is recorded in such a way that the equation remains balanced, which ensures all financial data is complete and verifiable. This meticulous record-keeping fosters trust among investors, creditors, and stakeholders, as they can have confidence in the integrity of the financial statements. Additionally, financing strategies should be assessed as they can determine the overall fiscal health. Companies can foresee potential cash flow problems and resolve them before they affect operations.

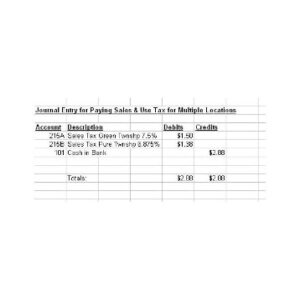

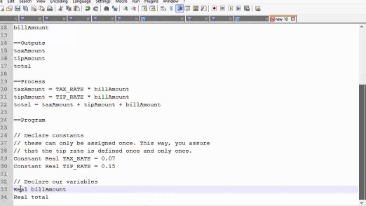

Incorrect classification of an expense does not affect the accounting equation. The major and often largest value assets of most companies are their machinery, buildings, and property. These may include Treasury bills and certificates of deposit (CDs). At the heart of HighRadius’s R2R solution is an AI-powered platform designed to cater to all accounting roles. One of the standout features of the solution is its ability to automate almost 50% of manual repetitive tasks. This is achieved through LiveCube, a ‘No Code’ platform, that replaces Excel and automates data fetching, modeling, analysis, and journal entry proposals.

In conclusion, financial ratios and performance allow stakeholders to examine various aspects of a company’s financial well-being, including liquidity, solvency, and profitability. By understanding these important metrics, investors can make informed decisions about a company’s potential growth and stability, ensuring long-term success. Fixed assets, also known as tangible assets, are physical items of value that a company owns and uses in its business operations. Some common examples of fixed assets include property, buildings, land, machinery, and equipment. The valuation of fixed assets involves determining their cost and factoring in depreciation. Current liabilities are obligations that the company should settle one year or less.