At the same time, both measures help analyze a company’s financial performance. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated.

Contribution margin on income statement

This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit. Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit. In these examples, the contribution margin per unit was calculated in dollars per unit, but another way to calculate contribution margin is as a ratio (percentage).

- The concept of this equation relies on the difference between fixed and variable costs.

- In the above example we calculated contribution per unit by subtracting variable cost per unit from selling price per unit.

- The contribution margin formula is essential for making the right decisions for your business – especially when creating budgets, accounting for inventory, and pricing products.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Contribution Margin Ratio: Definition

For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40). This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit. The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost). If the selling price per unit is more than the variable cost, it will be a profitable venture otherwise it will result in loss. All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units you sell, and then subtract the total variable costs from the total selling revenue.

Module 2: Cost-Volume-Profit Analysis

Whereas product B (animal plushies) has lower sales revenue and volume of units sold, it has a higher contribution margin. Contribution format income statements can be drawn up with data from more than one year’s income statements, when a person is interested in tracking contribution margins over time. Perhaps even more usefully, they can be drawn up for each product line or service. Here’s an example, showing a breakdown of Beta’s three main product lines.

What is the meaning of contribution margin?

To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit. The contribution margin is the amount of revenue in excess of variable costs. One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit.

Formula to Calculate Contribution Margin Ratio

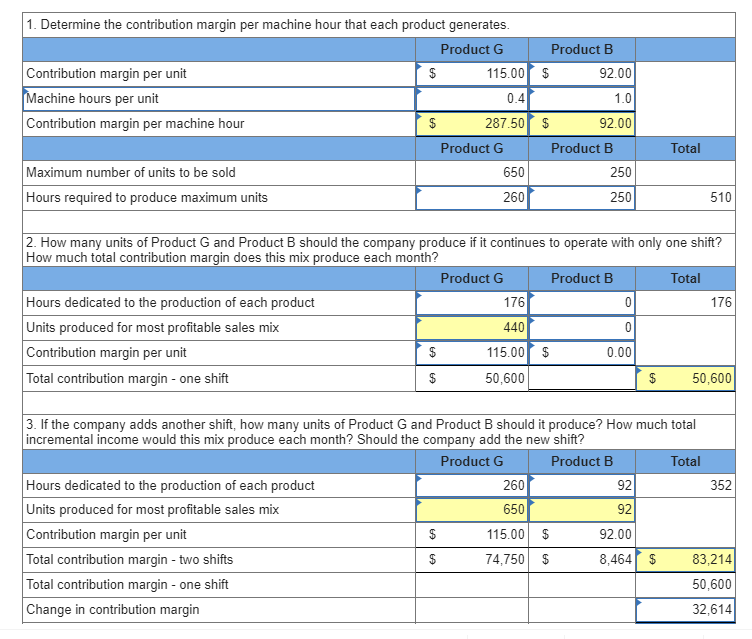

This can be achieved by automating key processes, optimising resource allocation, and eliminating waste. The contribution margin formula is essential for making the right decisions for your business – especially when creating budgets, accounting for inventory, and pricing products. It is the monetary value that each hour worked on a machine contributes to paying fixed costs. You work it out by dividing your contribution margin by the number of hours worked on any given machine.

The contribution margin is given as a currency, while the ratio is presented as a percentage. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. how to find contribution per unit Management should also use different variations of the CM formula to analyze departments and product lines on a trending basis like the following. Discover the key financial, operational, and strategic traits that make a company an ideal Leveraged Buyout (LBO) candidate in this comprehensive guide.

To enhance your contribution margin, it’s essential to analyse and adjust your product mix strategically. This means evaluating the profitability of each product and focusing on those that offer the best return on investment. A computer store might promote high-end laptops over budget models with lower margins. Contribution margin and gross margin are both important profitability metrics, but they differ in what they reflect about your business’s financial health.