So, which inventory figure a company starts with when valuing its inventory really does matter. And companies are required by law to state which accounting method they used in their published financials. Modern inventory management software like Unleashed helps you track inventory in real how to calculate fifo time, via the cloud.

FIFO vs. LIFO

When a business buys identical inventory units for varying costs over a period of time, it needs to have a consistent basis for valuing the ending inventory and the cost of goods sold. FIFO, on the other hand, is the most common inventory valuation method in most countries, accepted by International Financial Reporting Standards Foundation (IRFS) regulations. To calculate FIFO, multiply the amount of units sold by the cost of your oldest inventory. If the number of units sold exceeds the number of oldest inventory items, move on to the next oldest inventory and multiply the excess amount by that cost. LIFO usually doesn’t match the physical movement of inventory, as companies may be more likely to try to move older inventory first.

- In other words, the beginning inventory was 4,000 units for the period.

- In the FIFO method, your cost flow assumptions align with how the business actually operated in a given period.

- If you want to change your inventory accounting practices, you must fill out and submit IRS Form 3115.

- Jami Gong is a Chartered Professional Account and Financial System Consultant.

- At the start of the financial year, you purchase enough fish for 1,000 cans.

- For example, if LIFO results the lowest net income and the FIFO results in the highest net income, the average inventory method will usually end up between the two.

LIFO and FIFO: Impact of Inflation

If inflation were nonexistent, then all three of the inventory valuation methods would produce the same exact results. When prices are stable, our bakery example from earlier would be able to produce all of its bread loaves at $1, and LIFO, FIFO, and average cost would give us a cost of $1 per loaf. However, in the real world, prices tend to rise over the long term, which means that the choice of accounting method can affect the inventory valuation and profitability for the period.

- ShipBob provides a lot of distribution metrics, and everything presented is useful.

- Additionally, it ensures that you are more likely to use the actual price you paid for the goods in your income statements, making the calculations more accurate and simple, and record-keeping much easier.

- Although the ABC Company example above is fairly straightforward, the subject of inventory and whether to use LIFO, FIFO, or average cost can be complex.

- Though it’s one of the easiest and most common valuation methods, FIFO can have downsides.

- FIFO and LIFO are helpful tools for calculating the value of your business’s inventory and Cost of Goods Sold.

- Now, let’s assume that the store becomes more confident in the popularity of these shirts from the sales at other stores and decides, right before its grand opening, to purchase an additional 50 shirts.

- First-in, first-out (FIFO) is an inventory accounting method for valuing stocked items.

May Not Reflect Inventory Flow

The company has made the following purchases and sales during the month of January 2023. When a company selects its inventory method, there are downstream repercussions that impact its net income, balance sheet, and ways it needs to track inventory. Here is a high-level summary of the pros and cons of each inventory method. All pros and cons listed below assume the company is operating in an inflationary period of rising prices. For this reason, companies must be especially mindful of the bookkeeping under the LIFO method as once early inventory is booked, it may remain on the books untouched for long periods of time.

- Another reason why businesses would use LIFO is that during periods of inflation, the LIFO method matches higher cost inventory with revenue.

- It’s recommended that you use one of these accounting software options to manage your inventory and make sure you’re correctly accounting for the cost of your inventory when it is sold.

- This means that goods purchased at an earlier time are usually cheaper than those same goods purchased later.

- FIFO and LIFO aren’t your only options when it comes to inventory accounting.

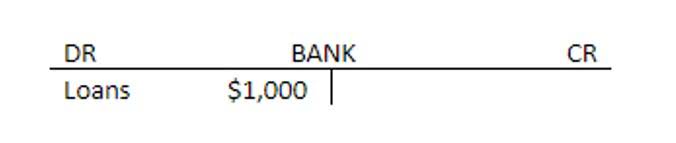

The FIFO (“First-In, First-Out”) method means that the cost of a company’s oldest unearned revenue inventory is used in the COGS (Cost of Goods Sold) calculation. LIFO (“Last-In, First-Out”) means that the cost of a company’s most recent inventory is used instead. With the help of above inventory card, we can easily compute the cost of goods sold and ending inventory. In addition, consider a technology manufacturing company that shelves units that may not operate as efficiently with age.

In short, any industry that experiences rising costs can benefit from using this accounting method. For some companies, there are benefits to using the LIFO method for inventory costing. For example, those companies that sell goods that frequently increase in price might use LIFO to achieve a reduction in taxes owed. Good inventory management software makes it easy to log new orders, record prices, and calculate FIFO. Accounting software offers plenty of features for organizing your inventory and costs so you can stay on top of your inventory value. FIFO assumes that assets with the oldest costs are included in the income statement’s Cost of Goods Sold (COGS).